Growth Opportunities for MVNOs in Global and U.S. Markets

Free Whitepaper: Market analysis and strategic outlook for MVNO expansion across North America, Europe, Asia-Pacific, and emerging regions.

The global MVNO market is entering a new era of differentiation—driven by consumer demand for affordable plans, 5G/eSIM adoption, IoT connectivity, and niche segmentation beyond price competition.

Why operators and investors need this guide?

- Global MVNO market size reached 83–91billionin2023,projectedtogrowto140–173 billion by 2030 at a 7–8.8% CAGR—but pure price competition is eroding ARPU and margins.

- In the U.S., MVNOs account for ~69% of consumer revenue, yet face intense pressure from MNO flanker brands like Cricket and Visible, plus regulatory complexity (FCC Form 499, USF, CPNI, CALEA).

- While Full MVNOs generate 56–60% of U.S. revenue, lightweight models struggle with network deprioritization during congestion—slowing speeds even on “unlimited” plans.

- eSIM adoption enables seamless switching, but only 55% of MVNOs have integrated it, and regulatory uncertainty remains (e.g., HAC compliance for eSIM-only providers).

- IoT/M2M is the fastest-growing segment, yet requires new operational models beyond traditional prepaid. Success now hinges on differentiation through bundling, customer experience, and strategic MNO partnerships—not just low cost.

What’s Inside This MVNO Opportunities Guide

- Global and U.S. market sizing, growth forecasts, and CAGR trends through 2030:

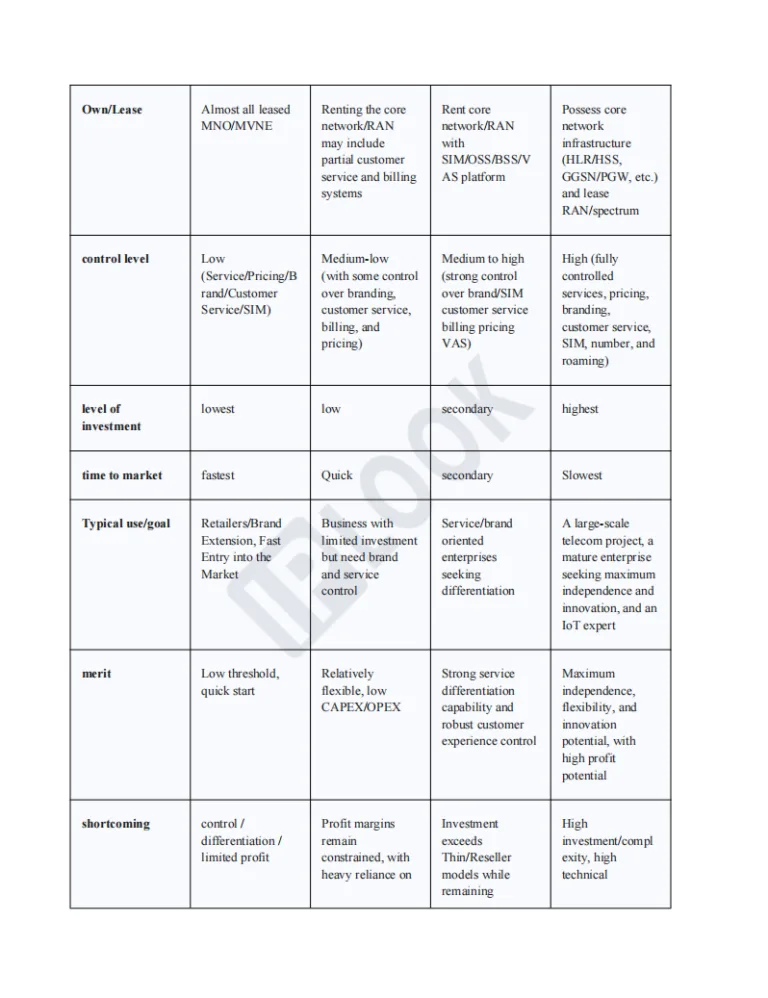

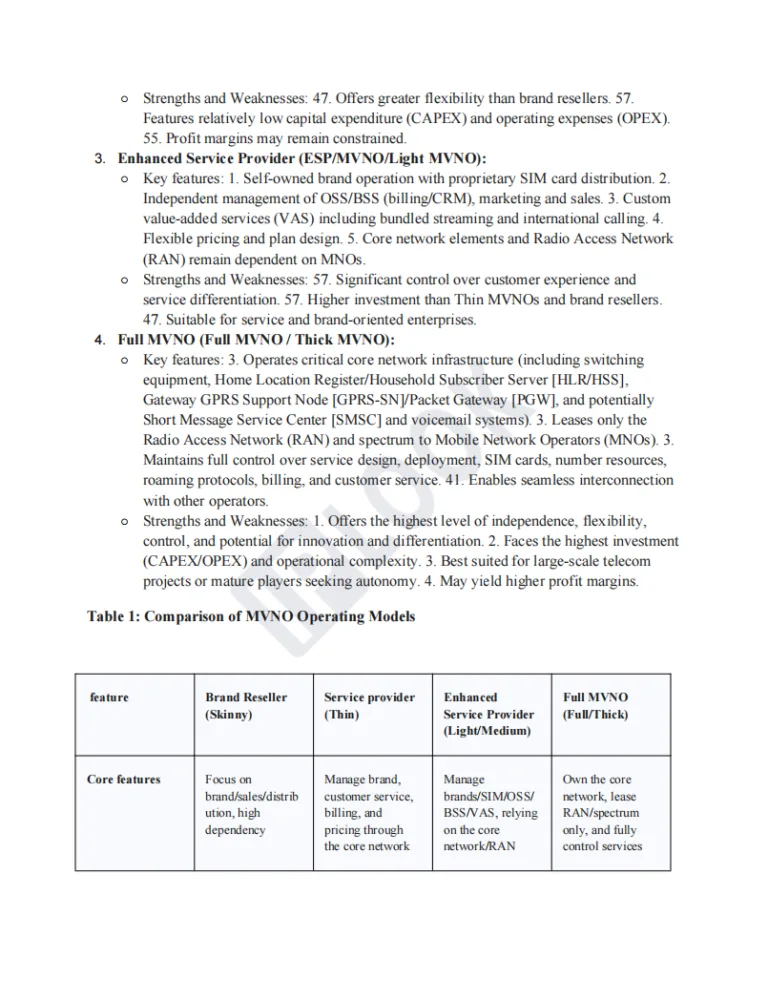

The global MVNO market is projected to reach $140–173 billion by 2030, growing at a 7–8.8% CAGR—with the U.S. contributing $28–30 billion annually. - Four MVNO operating models—from Branded Reseller to Full MVNO—and their trade-offs:

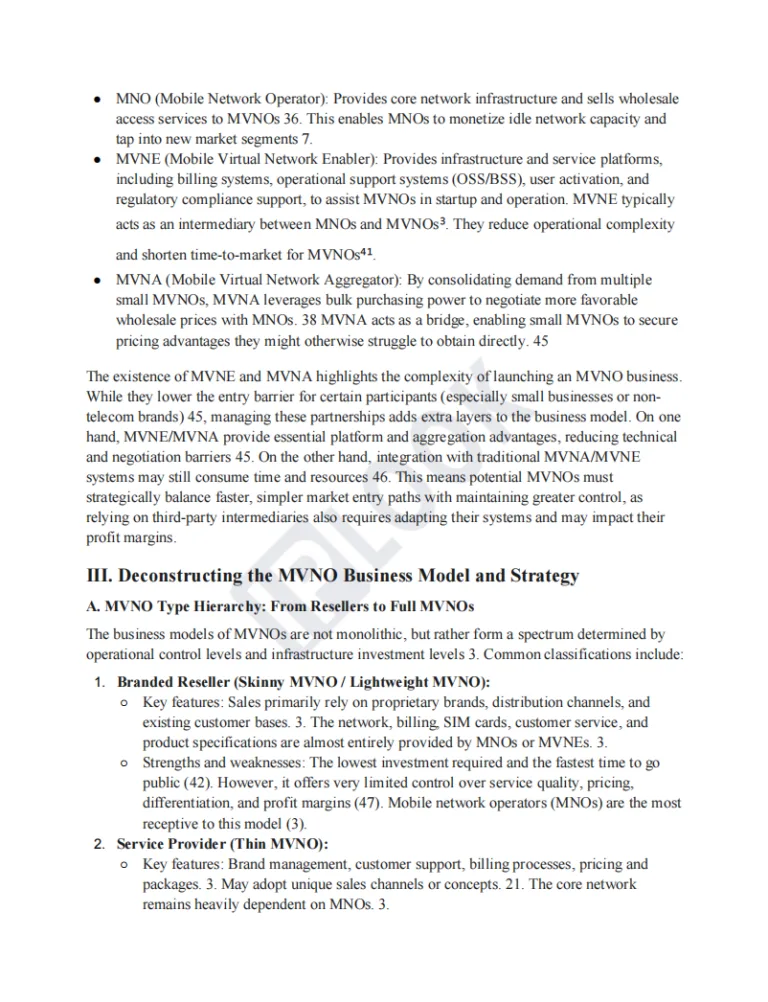

Understand the spectrum of control, cost, and complexity across Light, Thin, Thick, and Full MVNO architectures to choose the right entry strategy. - How Mint Mobile, TracFone, and Google Fi win through branding, pricing, and partnerships:

Leading MVNOs leverage MNO infrastructure while differentiating via customer experience, viral marketing, and bundled value—not just low prices. - Consumer pros and cons: cost savings vs. deprioritization, roaming limits, and device subsidies:

While MVNO plans offer significant savings, users often face network throttling during congestion, limited international roaming, and no subsidized devices. - The rise of IoT MVNOs and B2B enterprise opportunities in smart logistics and healthcare:

IoT/M2M is the fastest-growing segment—enabling MVNOs to move beyond consumer prepaid into high-margin, contract-based enterprise connectivity solutions. - How 5G, eSIM, and cloud core networks are reshaping MVNO independence and innovation:

eSIM enables seamless onboarding and global profiles, while cloud-native cores and network slicing open paths for true MVNO differentiation in the 5G era.

High Growth

Global MVNO market to exceed $170B by 2030, led by Asia-Pacific adoption

IoT Boom

M2M/IoT segment growing fastest in U.S. and Europe—key for B2B diversification

eSIM Revolution

Enabling digital-first onboarding, global roaming, and embedded connectivity for devices